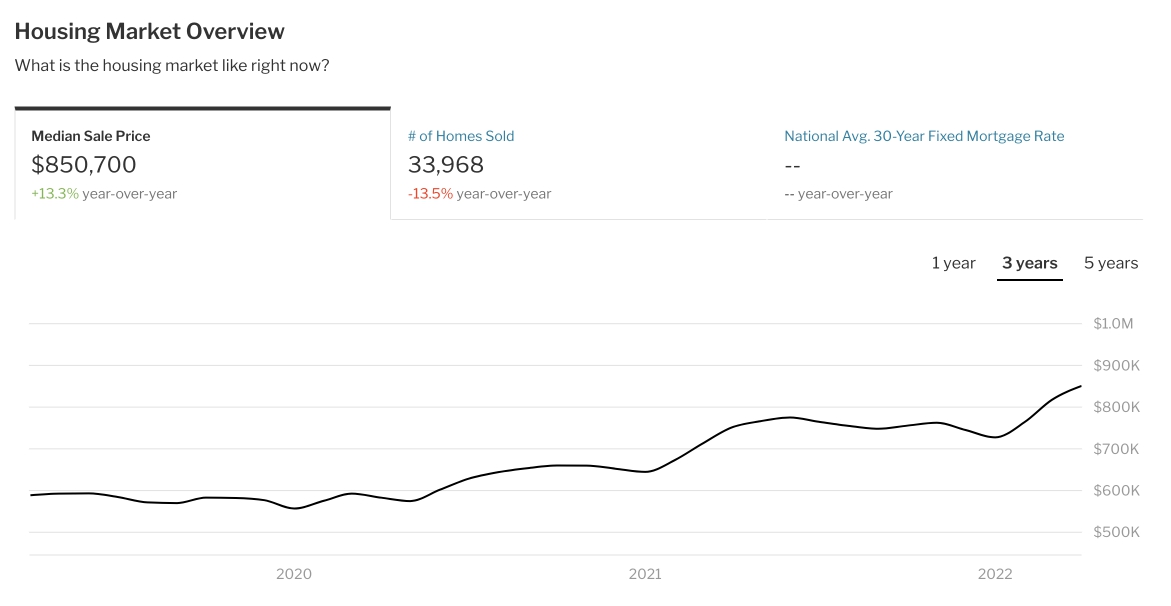

California housing market overview

image source: redfin.com

The California housing market continues to grow as buyers enter the market in anticipation of higher mortgage rates. Last year, the market exploded, breaking all records. At the state level, California's housing market remains the most valuable in the nation, with a total value of $9.24 trillion as of last December, more than one-fifth - 21.3% - of the national total, according to Zillow. The March price was 11.9% higher than the previous March when it was $758,990. The median price increase, as a percentage month-on-month, was the fastest since March 2013, and the 10.1% increase from February marked the first time in nine years that prices had risen more than 10% monthly. The pace of sales in March increased by 0.5% compared to the previous month. The cost of housing in California has been rising, which has affected its affordability. Only twenty-five percent of California households could afford to buy a house at an average price of $797,470 in the fourth quarter of 2021, up from 24% in the third quarter of 2021, but up from 27% in the fourth quarter of 2020. These trends show us that California's housing market remains very competitive. The growth in sales is driven by low mortgage rates, the desire of buyers to increase living space, and the constant shortage of housing. Homes sell quickly with minimal price reductions. The statewide sale price to list price ratio was 103.9% in March 2022 and 102.2% in March 2021. If it is less than 100%, the house is sold at a price below the list price. Strong demand across California's sub-markets means low inventories and lightning-fast market conditions aren't going away anytime soon. There are not enough houses for sale to meet the demand of buyers. The California Unsold Inventory Index (UII) was flat year-on-year at 1.7 months in March, the first time in almost two years that the index hasn't declined year-on-year. The index indicates the number of months it will take to sell the offer of houses on the market at the current level of sales. [su_spacer size="10"]