Check Our New Mortgage Tool

Find out your chances of getting loan in 1 minute. No credit check.

Get started

Why Choose LBC Mortgage Over a Traditional Bank?

You deserve a truly personalized mortgage experience, something traditional banks don’t provide. They typically treat you like any other number on a spreadsheet, while LBC Mortgage sees and honors the story behind the numbers.

We’re committed to creating solutions that align with your unique goals and needs.

| Services | Big Banks / Online Lenders | |

| No Administrative Fees | ||

| Access to 100+ lenders | ||

| In-house underwriting | ||

| A one-stop solution | ||

| Personalized approach | ||

| Minimum paperwork | ||

| Underwritten Pre-appovals | ||

| Bridge Loans |

Explore Our Loan Programs

Find the Right Fit for Your Needs

Get $5,000 in Perks once we close

Get Your RewardsHow We Simplify Your Loan Process

From consultation to closing, we make the mortgage process easy and stress-free.

-

Schedule a Free Consultation Today

No sales pressure, just expert advice to help you and find right option for your needs.

-

We Analyze Options from 100+ Lenders

Our team compares offers and finds the perfect solution for your needs.

-

We Handle All the Paperwork

We take care of all documentation and guide you through the closing process.

-

Your Deal Is Closed, Successfully

Congratulations! You've successfully secured your loan and are ready for the next step.

Get Your Free Consultation

Speak with a mortgage expert — no sales talk, no pressure, just the details you need to take a smart decision.

Schedule a ConsultationTop-Rated Mortgage Broker

What can you expect from the LBC Mortgage? Extraordinary, stress-free service that saves you time, energy, and money — all delivered seamlessly by our team of highly experienced professionals. Since 2008, we’ve closed over $1 billion in loans.

Meet the TeamSee Why People Choose Us

Take Advantage of Our Tools

-

Home Value Report

Get a free home value report that gives you the tools you need to manage your home like the powerful investment it is.

Get Started -

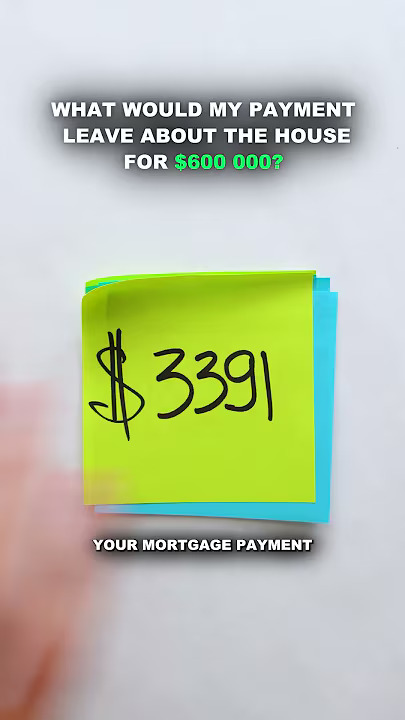

Mortgage Calculator

Our Mortgage Calculator helps you estimate your monthly payments based on loan amount, interest rate, and loan term.

Let’s Calculate -

Loan Limits

Check what limits are allowed in your county.

Loan Limits

Your Mortgage Roadmap – Free Access

Learn best practices and strategies to gain invaluable insight from experts in the field. Become a savvy pro with up-to-date knowledge on real estate trends that will help you succeed!

Get Free CoursePersonalized Services for Homebuyers

Tailored Mortgage Solutions Across Ten States

Whether you’re a first-time buyer or looking to refinance, LBC Mortgage provides personalized home loan solutions across ten states. Our team of licensed mortgage professionals serves communities in California, Florida, Illinois, Colorado, Washington, Texas, North Carolina, South Carolina, Pennsylvania and Oregon offering expert guidance throughout your home financing journey. Additionally, if you’re seeking financing for an investment property, we offer nationwide services to meet your needs. We’re committed to making the mortgage process straightforward while helping you achieve your homeownership goals.

Why Choose LBC Mortgage?

LBC Mortgage takes a more personal approach than conventional lenders, taking time to understand your unique circumstances. Our customized mortgage solutions are designed to match your individual financial profile and goals. From first-time buyers to experienced investors and business owners, we have the knowledge and tools to find your ideal mortgage option. Our dedicated team works tirelessly to ensure you not only get competitive rates but also receive the support and guidance you deserve throughout the lending process.

Multilingual Expertise

Our diverse team breaks down language barriers by offering mortgage services in English, Spanish, Russian, Ukrainian and Hebrew. This multilingual approach ensures clear communication and helps you feel at ease while discussing your home financing needs. Whether you prefer to speak in your native language or English, our knowledgeable professionals will guide you through each step with clarity and cultural understanding, making your mortgage journey smoother and more comfortable.

| Services | | Banks |

| No Administrative Fees | ||

| Access to 100+ lenders | ||

| In-house underwriting | ||

| A one-stop solution | ||

| Personalized approach | ||

| Minimum paperwork | ||

| Underwritten Pre-appovals | ||

| Bridge Loans |

Mortgage Broker VS. Traditional Banks

When it comes to securing a mortgage, LBC Mortgage stands out as a superior alternative to traditional banks. Unlike banks, which often treat clients as just another application, LBC Mortgage provides a personalized experience tailored to each client’s unique needs. With no broker fees and minimal paperwork, our process is streamlined to save you time and money. Our one-stop solution means you’ll receive comprehensive support throughout your home-buying journey, ensuring a seamless and hassle-free experience.

Another major advantage is our access to a network of over 100 lenders, giving you unmatched flexibility to find the best rates and terms. Traditional banks are often limited in their options, while LBC Mortgage provides a wider range of loan programs to meet your specific requirements. Whether you’re a first-time homebuyer or an experienced investor, we’re here to offer solutions designed to help you achieve your goals with ease and confidence.

Our Services Include

-

Customized Loan Options

Whether you’re looking for FHA, Сonventional, NON-QM, Portfolio, Hard Money Loan, we tailor solutions to meet your needs.

-

Credit Score Improvement Guidance

We help you boost your credit profile to secure better rates.

-

Real Estate Market Insights

Stay informed with updates on housing trends and opportunities.

-

Minimal Paperwork

We handle the documentation so you can focus on what matters most.

Get Started Today

Your journey to homeownership starts here. With our expertise and commitment to customer service, we make the process straightforward and stress-free. Take the first step by entering your email to schedule a free consultation.

Get StartedWhy Clients Love LBC Mortgage

-

Personalized Attention

From start to finish, a dedicated manager will guide you, ensuring your questions are answered promptly.

-

Exceptional Support

We simplify complex processes and ensure you have a hassle-free experience.

-

Multilingual Team

We speak different languages to ensure you feel understood and valued.

Get in Touch

Whether you’re buying a home or are ready to refinance, our experts are here to help.

All You Need to Know About Mortgages

View More Articles

SB 79 Explained: Why More Homes Near Transit Could Help First-Time Buyers

The Lock-In Effect Is Creating Opportunity: Why New Buyers Have Negotiation Power in California

California Dream For All 2026: How to Qualify and Buy a Home with Little or No Down Payment

Frequently Asked Questions

General Questions

1. How do I get pre-approved for a mortgage loan through LBC Mortgage?

To obtain a mortgage pre-approval through LBC Mortgage, a borrower must complete a structured financial review that confirms their ability to qualify for a specific loan range. Pre-approval begins with a discussion of your intended property type, occupancy (primary residence, second home, or investment), and purchase timeline. Based on that context, LBC Mortgage identifies which loan programs are potentially suitable before documentation is collected.

The pre-approval review typically requires verification of income, assets, and credit. Income documentation varies by loan type and may include recent pay stubs and W-2s for salaried borrowers, or tax returns, bank statements, or other alternative documentation for self-employed or non-traditional income profiles. Asset verification confirms the availability of funds for down payment, closing costs, and required reserves. Credit history is evaluated to confirm minimum score thresholds and overall creditworthiness.

Once documentation is reviewed, LBC Mortgage issues a pre-approval letter reflecting an estimated loan amount and program fit, subject to property appraisal and final underwriting. This letter signals to sellers and real estate agents that financing has been reviewed upfront, strengthening purchase offers and reducing the risk of delays. A pre-approval does not obligate the borrower to proceed with a loan, but it establishes financial readiness and clarifies realistic price ranges before entering a purchase contract.

2. Can I qualify for a mortgage if I’m self-employed?

Yes, self-employed borrowers can qualify for a mortgage through LBC Mortgage, even if their income structure makes approval difficult with conventional lenders. Unlike banks that rely almost exclusively on W-2 income and tax-return net figures, LBC Mortgage evaluates self-employed applicants using a broader set of qualification methods tailored to business owners and independent professionals. The process begins with a review of how income is earned, how long the business has been operating, and what documentation best represents true cash flow.

Depending on the loan program, income may be verified using two years of tax returns, 12 or 24 months of personal or business bank statements, 1099 forms, or a combination of documentation supported by a CPA letter. For borrowers whose tax returns show reduced income due to write-offs, bank statement programs can be especially effective because they assess average monthly deposits rather than taxable net income. LBC Mortgage also offers investor-focused programs, such as DSCR loans, that qualify based on property cash flow instead of personal income altogether.

In addition to income review, LBC Mortgage evaluates assets, credit history, and required reserves to ensure overall loan stability. This holistic approach allows self-employed borrowers to access mortgage options that align with real-world earnings rather than rigid formulas. By matching each borrower with the appropriate documentation pathway and lender guidelines, LBC Mortgage helps self-employed individuals move forward with realistic approvals and clearer expectations throughout the loan process.

3. Can I get a mortgage without showing my taxes?

Yes, it is possible to obtain a mortgage without providing tax returns through LBC Mortgage, depending on the loan program and borrower profile. Certain non-traditional mortgage products are structured specifically to accommodate borrowers whose tax filings do not reflect their true earning capacity due to business write-offs, depreciation, or variable income. Instead of relying on tax returns, these programs use alternative methods to assess repayment ability.

One common option is a DSCR (Debt Service Coverage Ratio) loan, which is primarily used for rental properties. DSCR loans qualify borrowers based on the property’s rental income relative to its monthly housing expense rather than the borrower’s personal income. When the rental income meets or exceeds the required DSCR threshold, personal tax returns, W-2s, and pay stubs are typically not required. This structure is especially useful for real estate investors and self-employed individuals who own income-producing properties.

Another alternative is a bank statement mortgage, which evaluates income using 12 to 24 months of personal or business bank statements. In this case, income is calculated from deposit history instead of reported taxable income. These programs still require verification of assets, credit history, and reserves, but they remove the need to submit full tax returns. By offering multiple non-tax-return qualification paths, LBC Mortgage enables borrowers to pursue financing that better reflects real-world cash flow while maintaining responsible underwriting standards.

4. What should I do if my credit score isn’t perfect?

If your credit score is not ideal, it does not automatically prevent you from qualifying for a mortgage through LBC Mortgage. Many borrowers enter the mortgage process with credit challenges such as limited credit history, past late payments, higher balances, or prior financial disruptions. Rather than relying solely on a single score threshold, LBC Mortgage evaluates credit as one part of a broader financial profile that includes income stability, assets, down payment strength, and loan structure.

The first step is a credit review to understand what factors are affecting the score. This may include high credit utilization, collections, or reporting errors. Based on that review, LBC Mortgage can outline practical steps that may help improve credit positioning, such as reducing balances, correcting inaccuracies, or adjusting application timing. In some cases, modest improvements over a short period can meaningfully expand available loan options.

At the same time, LBC Mortgage can identify mortgage programs that are designed to be more forgiving of credit imperfections. Certain conventional, FHA, and non-QM loan options allow lower minimum credit scores when other compensating factors are present, such as higher down payments or stronger reserves. For investors, DSCR loans may rely more heavily on property cash flow than personal credit alone. This flexible, solution-oriented approach helps borrowers move forward with realistic expectations and a clear path toward homeownership or investment financing, even while credit is still a work in progress.

5. How long does the mortgage process usually take?

The timeline can vary, but once your application is complete and we have all the documents, we aim to close within 30 days. Our efficient process and dedicated team help keep things moving quickly. Want to know more about the steps? Contact us!

Refinancing

1. What is refinancing, and why should I consider refinancing through LBC Mortgage?

Refinancing is the process of paying off an existing mortgage with a new loan that has different terms, and it can serve multiple strategic purposes depending on a borrower’s situation. Through LBC Mortgage, refinancing is approached as a financial restructuring decision rather than a one-size-fits-all transaction. Borrowers may refinance to secure a lower interest rate, which can reduce monthly payments and total interest paid over the life of the loan, particularly if market rates have improved or credit has strengthened since the original purchase.

Another common reason to refinance is to change the loan term or structure. For example, extending a loan back to a 30-year term can lower monthly obligations and improve cash flow, while shortening the term can help build equity faster and reduce long-term interest expense. Some borrowers refinance to switch from an adjustable-rate mortgage to a fixed-rate loan to gain payment stability, or to move from interest-only to fully amortizing payments as financial priorities change.

Refinancing can also be used to access home equity through a cash-out refinance. This allows homeowners or investors to convert a portion of their accumulated equity into cash, which may be used for home improvements, debt consolidation, business needs, or additional real estate investments. LBC Mortgage evaluates refinancing scenarios by reviewing current loan terms, property value, equity position, and long-term objectives to determine whether refinancing provides a meaningful financial benefit rather than short-term relief alone.

2. When is the right time to refinance my mortgage?

Determining whether it is the right time to refinance involves evaluating how a new loan would improve your overall financial position compared to your existing mortgage. With LBC Mortgage, refinancing decisions are based on a combination of market conditions and personal objectives rather than interest rates alone. A common trigger is when current interest rates are meaningfully lower than your existing rate, which may reduce monthly payments or long-term interest costs. However, rate changes are only one part of the equation.

Credit profile improvements can also make refinancing attractive. If your credit score has increased since you obtained your original loan, you may qualify for better pricing or more flexible loan programs. Equity growth is another key factor. As your property value increases or your loan balance decreases, refinancing options such as removing mortgage insurance or accessing cash through a cash-out refinance may become available.

Loan structure and future plans also matter. Borrowers sometimes refinance to switch from an adjustable-rate mortgage to a fixed-rate loan for payment stability, extend the loan term to improve monthly cash flow, or shorten the term to accelerate equity buildup. The length of time you plan to keep the property is important as well, since refinancing costs should be weighed against the expected savings over that period. By reviewing current loan terms, market conditions, and long-term goals together, refinancing becomes a strategic decision rather than a reactive one.

3. Can I refinance my mortgage without any equity?

Refinancing a mortgage without significant equity may still be possible depending on the type of loan you currently have and your payment history. Through LBC Mortgage, borrowers can explore refinance programs that are designed to reduce friction when property values have not increased or when loan balances remain close to the home’s market value. These programs are typically intended to improve loan terms rather than extract equity.

For homeowners with FHA loans, the FHA Streamline Refinance program may allow refinancing without a new appraisal, meaning the amount of available equity is not the primary qualification factor. Instead, lenders focus on on-time payment history, net tangible benefit, and existing FHA loan status. Similarly, eligible VA borrowers may qualify for an Interest Rate Reduction Refinance Loan (IRRRL), which allows refinancing with minimal documentation and no appraisal requirement in many cases. These options are generally limited to borrowers refinancing into the same government-backed loan type.

Outside of streamline programs, most conventional and non-QM refinances require some level of equity, as loan-to-value ratios play a central role in underwriting. However, even when equity is limited, restructuring loan terms—such as adjusting the interest rate, loan term, or payment structure—may still be achievable under specific guidelines. Reviewing the current loan type, payment performance, and refinancing objective helps determine whether a no-equity or low-equity refinance is feasible and whether it delivers a meaningful financial improvement rather than a temporary adjustment.

4. What documents do I need to refinance my mortgage?

T

he documents needed to refinance a mortgage can vary significantly based on your financial profile and the type of refinance you are pursuing. When working with LBC Mortgage, the documentation process is aligned to the specific loan program rather than applying a single checklist to every borrower. The goal is to verify income stability, assets, credit, and property details in a way that reflects how you actually earn and manage money.

For borrowers with traditional W-2 income, refinancing typically requires recent pay stubs, W-2 forms from the prior two years, and a verification of employment. Self-employed borrowers may instead provide two years of personal and business tax returns, or alternative documentation such as 12 or 24 months of personal or business bank statements if using a bank statement refinance program. Real estate investors refinancing rental properties under DSCR guidelines may not need personal income documentation at all, as qualification is based on the property’s rental income relative to its monthly expenses.

In addition to income documentation, most refinances require recent bank statements to verify assets for closing costs and reserves, a copy of the current mortgage statement, homeowners insurance information, and identification. Credit is pulled as part of the review, and an appraisal may be required depending on the loan type and equity position. By matching documentation requirements to the appropriate refinance program, the process becomes more efficient and avoids unnecessary paperwork while maintaining responsible underwriting standards.

5. How long does the refinancing process take?

The length of the refinancing process depends on several variables, but most refinance transactions are completed within approximately 30 to 45 days. When refinancing through LBC Mortgage, timelines are driven by the specific loan program, the borrower’s documentation profile, and how quickly third-party items such as appraisals and title work are completed. The process begins with an initial review of the existing loan, refinancing goals, and eligibility for available programs.

Documentation plays a major role in timing. Borrowers with straightforward W-2 income and strong credit profiles often move through underwriting more quickly, while self-employed borrowers or investors using alternative documentation may require additional review steps. However, certain refinance options—such as FHA Streamline or VA Interest Rate Reduction programs—can close more quickly because they may not require a new appraisal or extensive income verification. For rental property refinances using DSCR guidelines, qualification based on property cash flow rather than personal income can also reduce processing time.

External factors also affect the timeline. Appraisal scheduling, title report turnaround, and responsiveness to document requests can either shorten or extend the process. Market conditions and lender volume may influence underwriting speed as well. Throughout the refinance, setting clear expectations and responding promptly to documentation requests helps keep the transaction on track. While exact timelines vary, most refinances follow a predictable sequence, allowing borrowers to plan with reasonable confidence from application to closing.