Introducing the Prequalifier Tool

At LBC Mortgage, we take a lot of interest in the confidence of homebuyers throughout their mortgage journey. In fact, the path toward a loan might be intimidating and knowing your likeliness of approval in advance will save time and lots of stress. That's why we bring you the Prequalifier Tool.

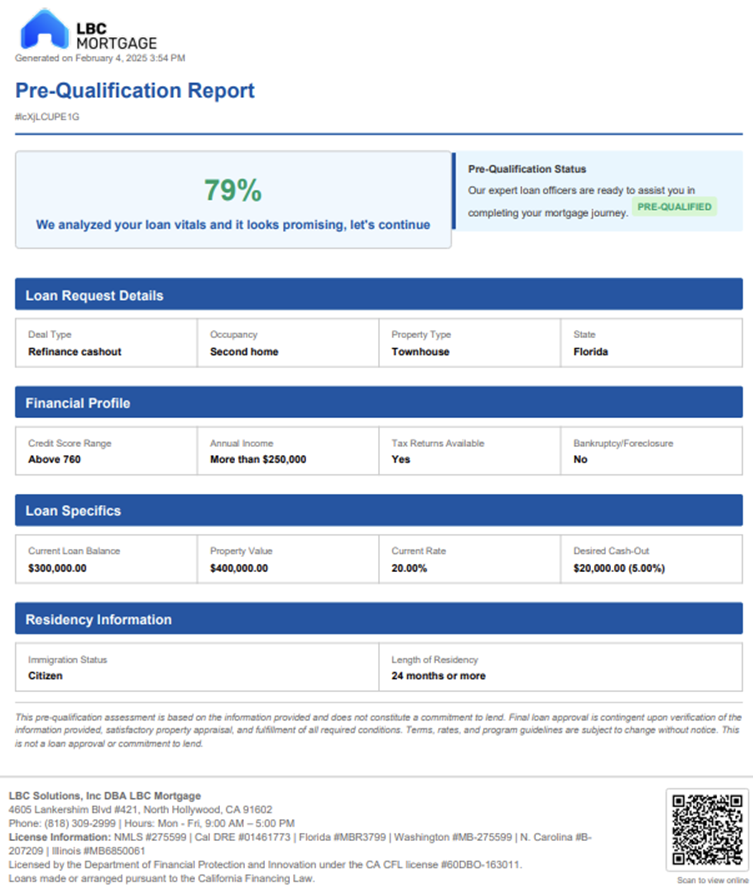

It will enable you to prequalify for a mortgage before applying. You get an early evaluation from the information you provide; hence, you will know where you stand. Our Prequalifier provides you with valuable insights into your eligibility to make informed decisions about your mortgage options.

Our Prequalifier Tool is friendly and highly informative. It considers some key financial details, such as your credit score, income, and loan amount, to estimate the chances of your loan approval. The results are given in the form of a prequalification percentage that helps you understand your chances.

Refinancing or buying that second home, the Prequalifier Tool presents you with the fastest, surefire way to get started. You will instantly know whether or not you're on track in securing your mortgage. With our tool, this is made so much easier you can confidently make the next move.

How the Prequalifier Tool Works

How the Prequalifier Tool Works

LBC Mortgage's Prequalifier Tool is designed to make the mortgage application process easier and faster. It provides an early look at your likelihood of approval based on some of your key financial information, like credit score, income, loan amount, and other important details. It takes in that information and spits out a prequalification percentage that will tell you how likely you are to be approved for the loan.

For example, a prequalification score of 79% means that your financial profile matches well with the loan requirements, suggesting you have a good chance of approval. The score is based on factors like your credit score range, annual income, property type, and more, all of which are carefully considered by the tool.

Understanding the Prequalification Percentage

This will be an easy-to-understand metric showing how far you have been able to reach the requirements for a loan. Based on data, such as those you input, the resultant prequalification percentage gives a rapid insight into your position within the mortgage process. The higher the percentage, the better the chance; the lower the score, the greater the likelihood there are issues that need improvement before considering an application for the loan.

What Happens Once You've Got Your Prequalification Report

Once you have obtained your prequalification, you are free to download a personalized report which will closely look into your financial profile and details regarding the loan. This will further help in determining your standing with regard to mortgage. Review it to be well-informed and to take up further decisions with regard to further steps to be taken.

This personalized report will also assist you in making a decision as to whether you are ready to proceed with a formal mortgage application or if some changes need to be made in your financial situation. With this clear and detailed report in your hands, you are better equipped to take on the process of applying for a mortgage application with confidence.

Benefits & Next Steps for Homebuyers

The Benefits of Using the Prequalifier Tool

The LBC Mortgage Prequalifier Tool offers several advantages. First, it saves your precious time: instead of waiting weeks for an official loan pre-approval, this tool responds right away. You get early notice of your chances and, thus, can make prompt decisions regarding mortgage options.

The tool will also provide you with more confidence while approaching the homebuying process. In understanding your prequalification score, you will further understand your financial situation and how it does or does not meet the loan requirements. This positions you to go forward in the mortgage process with some idea of what to expect.

Another major plus when it comes to the Prequalifier Tool is that it makes the mortgage process simpler. It takes a lot of the guesswork out, giving you an actual analysis based on your financial information. Whether you're buying your first home or refinancing your current one, this tool will give you confidence and ease into the process.

How to Proceed After Your Prequalification Results

Once you get your prequalification results, the next thing you need to do is to review the personalized report. This document outlines your financial profile, including your credit score, income, loan amount, and other relevant details. It also shows your prequalification percentage, helping you determine how strong your chances of approval are.

If the results sound promising, the next thing one would want to do is speak with a loan officer. Here at LBC Mortgage, we are prepared and set to take you through the next steps that will help you finalize your loan application. We will be walking you through all this: from gathering required documents to scheduling a property appraisal to finalizing your loan terms.

Even if the results turn up areas for improvement, our loan officers can help you understand what changes might increase your likelihood of approval. Whether improving your credit score or adjusting the loan request, we offer all the support to get you on the right track.

Get Started Today

The Prequalifier Tool is an easy and quick way to get started on your mortgage journey. Try it out for yourself today on our website and see where you stand. If you have any questions or want further assistance, our team at LBC Mortgage is here to help. With our expert guidance and the power of the Prequalifier Tool, you'll be well on your way to securing the home of your dreams.