Mortgage interest rates overview

Rates have inched higher even as home sales have cooled in many markets around the country and as bond yields have come down from their recent highs. Mortgage applications fell 4 percent last week from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. The 30-year fixed-rate average jumped to 5.66 percent with an average 0.8 points this week, up from 5.54 percent last week and 2.87 percent a year ago. The 30-year fixed average hasn’t been this high since late June. The 15-year fixed-rate average increased to 5.15 percent with an average 0.7 points, up from last week when it averaged 5.12 percent. It was 2.61 percent a year ago. The five-year adjustable rate average ticked up to 5.36 percent with an average 0.6 points, compared with 5.35 percent last week and 3.11 percent a year ago. Despite the recent rate uptick in mortgage trends, potential homebuyers may be encouraged by signs that prices may be stabilizing. So, here is how the purchase behavior has changed.How have mortgage rates influenced home buyers' behavior?

As a result of real estate market changes and instability, many home buyers have turned to adjustable-rate mortgages instead of fixed mortgages. An adjustable-rate mortgage, or ARM, is a type of home loan that begins with a fixed interest rate for a set period of time, usually 5 years. After that initial period, the interest rate will adjust annually based on current market conditions. Because ARM rates can fluctuate over time, they may be higher or lower than the rate on a traditional fixed-rate mortgage. However, they usually start out lower, making them an attractive option for homebuyers who are looking to save money in the short term. The main reason for such mortgages being popular today is that borrowing costs have swelled, and adjustable-rate mortgages offer more flexibility in terms of monthly payments. Also, lower interest rates of adjustable-rate mortgages played their role. And home buyers spend more time comparing offers from multiple lenders to get the best deal possible. But according to experts, instead of comparing ARM rates, it is better to consider fixed-rate mortgage programs. Especially if you plan to stay in your home for the long term, a traditional fixed-rate mortgage may be a better option. Wonder why?Why fixed-rate mortgages win

A fixed-rate mortgage is a type of home loan in which the interest rate remains constant for the life of the loan. This means that your monthly payment will never increase, no matter how long you stay in your home. This can provide peace of mind for borrowers who are worried about interest rates rising in the future. Fixed-rate home loans offer borrowers a degree of certainty that can be difficult to find in other types of financing. As interest rates fluctuate, borrowers with adjustable-rate loans can see their monthly payments increase or decrease, making budgeting difficult. On the other hand, fixed-rate loans offer a consistent monthly payment, making it easier for borrowers to plan their finances. In addition, if interest rates decline in the future, fixed-rate borrowers may be able to refinance their loans and lower their monthly payments. [su_spacer size="10"][su_note note_color="#ffffff" text_color="#000000" radius="0"]Do you plan to buy a home? [su_button url="https://alexshekhtman.floify.com/apply-now" target="blank" style="flat" background="#0072ff" size="4" radius="round" icon="icon: home" icon_color="#ffffff"]Apply now[/su_button] [/su_note]

When will mortgage rates go down?

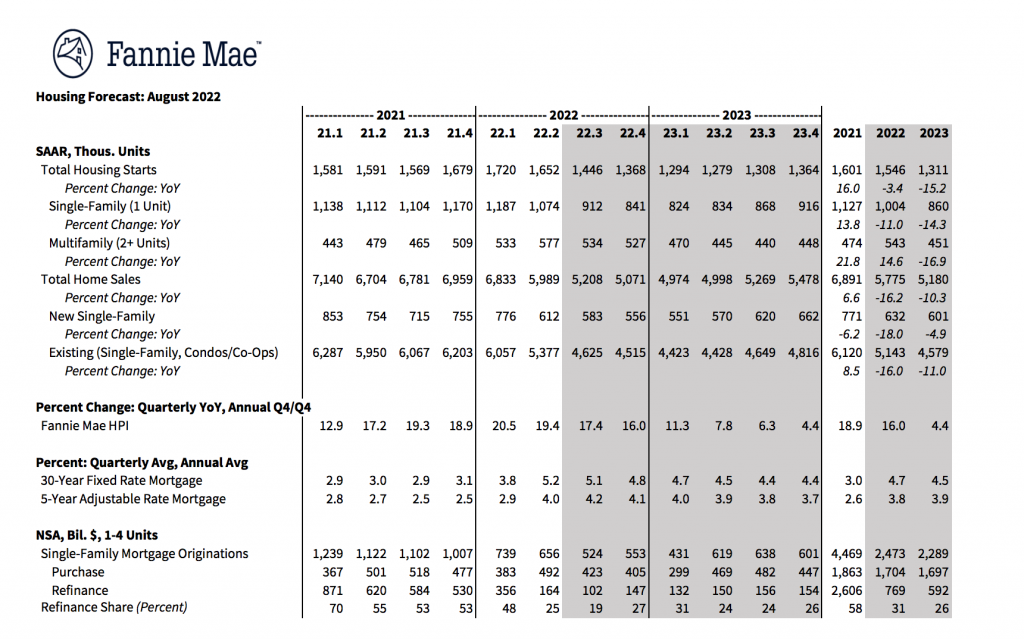

So, will the mortgage rates be lower in 2023? Fannie Mae's recent housing forecast predicts that the rate on a 30-year fixed mortgage will fall to an average of 4.5% by 2023. This would be a welcome relief for potential homebuyers who have seen mortgage rates rise sharply this year.

Image source: fanniemae.com

The current level of interest is a significant barrier for many buyers. A decrease in rates would help to make purchasing a home more affordable and could lead to increased demand in the housing market. But for those thinking of buying a home in the near future, waiting may be a tricky decision. And here is why.