Lending Expertise in Eight Key States

At LBC Mortgage, we make it easy for homebuyers, real estate investors, and self-employed professionals to secure the right loan — no matter where they live. With a presence in eight major states and access to over a dozen lending programs, we offer flexible financing solutions tailored to local markets. Here’s how we help clients succeed in each of these states with the personalized service and speed that set us apart.

California

Lending That Moves as Fast as the Market

California’s real estate market is one of the most competitive in the country. That’s why we offer 17 types of loan programs designed to move deals forward quickly. From Los Angeles to San Francisco, buyers rely on our deep knowledge of state regulations and local market conditions.

We help first-time buyers get into their homes with FHA, VA, and conventional loans. For those buying high-value properties, we offer jumbo loans and 80-10-10 piggyback options to reduce down payment requirements. Investors benefit from our DSCR, bank statement, and fix-and-flip loans. No matter your goal, we provide fast, responsive service that gets you to closing on time.

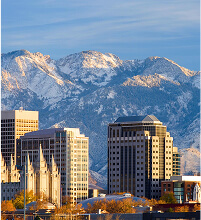

Colorado

Custom Financing for Mountain and Metro Living

Colorado offers both urban and rural opportunities for homeowners and investors. With 19 loan types available, we help buyers finance properties in places like Denver, Boulder, and Colorado Springs with ease.

We support clients building custom homes with construction loans and help investors scale their portfolios with Airbnb mortgage loans, investor cash flow loans, and hard money programs. For self-employed clients, our bank statement and VOE loans remove the stress of documentation. We simplify the lending process in a state where flexibility is key.

Florida

Fast Closings in a Competitive Market

Florida’s real estate market continues to attract retirees, international buyers, and growing families. We’re proud to offer 17 types of loans that meet the needs of this diverse client base.

Our loan programs include conventional, FHA, VA, and jumbo loans, as well as non-QM options like ITIN loans and the no tax return program. We also serve non-US residents buying vacation or investment properties. With our extensive experience and streamlined processes, we help Florida buyers compete and win in this fast-paced market.

Illinois

Big Solutions for the Midwest

Illinois borrowers need a lender who can handle everything from Chicago multifamily deals to single-family homes in the suburbs. We deliver with 19 loan types designed to cover all scenarios.

Our clients take advantage of FHA and VA loans for primary residences, and commercial loans for business ventures. We also offer HELOCs, portfolio loans, and DSCR options for property investors. With tailored support and local insight, we make the loan process smooth, even in a competitive market like Chicago.

Pennsylvania

Financing for America’s Industrial Heart

From Philadelphia rowhomes to Pittsburgh investment properties, Pennsylvania borrowers need versatile lending options — and we deliver. We provide 18 loan types built to support homebuyers, investors, and business owners across the state.

Our clients leverage FHA and VA programs for primary residences, DSCR loans for rental portfolios, and commercial financing for mixed-use assets. We also offer renovation loans ideal for Pennsylvania’s older housing stock, along with refinancing options to improve cash flow. With personalized guidance and quick turnaround times, we help borrowers stay competitive in tight local markets.

North Carolina

Smart Lending for Growing Communities

North Carolina continues to attract buyers with its mix of job growth and quality of life. We offer 13 loan programs that help buyers move quickly in cities like Charlotte, Raleigh, and Durham.

We serve a range of clients, from first-time homebuyers using FHA and VA loans to experienced borrowers seeking jumbo and conventional options. Investors benefit from fix-and-flip financing and asset depletion loans. Whether you’re relocating or expanding your portfolio, we offer solutions that keep things moving.

South Carolina

Flexible Financing for Every Borrower

With 17 loan types, we bring flexible mortgage solutions to cities like Charleston, Columbia, and Greenville. South Carolina’s mix of new development and historical properties requires financing expertise—and that’s what we provide.

Our clients rely on us for everything from new construction loans to HELOCs for home upgrades. Self-employed borrowers and those without traditional income documentation benefit from our no-doc and bank statement loans. We work hard to find a path forward for every scenario, even when others can’t.

Texas

Big Opportunities, Bigger Service

Texas is one of the fastest-growing states in the country, and we meet that demand with 17 loan options built for speed and versatility. Whether you’re buying a home in Austin or investing in a rental in Dallas, we’ve got you covered.

We provide conventional, FHA, VA, and jumbo loans for homeowners. Investors use our DSCR, commercial, and fix-and-flip programs to build long-term wealth. Our team understands Texas’ real estate trends and tailors every loan accordingly. Fast approvals, minimal paperwork, and responsive communication set us apart.

Washington

Lending That Works Coast to Coast

From Seattle to Spokane, we offer 17 types of loans to help Washington clients buy, build, and invest. Whether you’re financing a single-family home or expanding into multifamily real estate, we have the tools to support you.

We offer investor-friendly products like Airbnb loans and hard money loans, plus flexible solutions for self-employed professionals. Our clients rely on us for competitive rates, smooth closings, and the kind of personal attention that national lenders just don’t provide.

Oregon

Smart Lending for the Pacific Northwest

Whether you’re buying in Portland or developing property in Bend, Oregon borrowers benefit from 16 flexible loan types tailored to Northwest lifestyles and investment opportunities.

We offer construction loans for new builds, DSCR loans for rental income properties, and jumbo loans for high-value homes. Self-employed borrowers can take advantage of bank-statement programs, while investors appreciate access to bridge and hard money solutions. With responsive service and streamlined closings, we make financing stress-free — even in Oregon’s fast-moving real estate market.

Nationwide Programs

In addition to our state-specific lending services, we offer DSCR (Debt Service Coverage Ratio) loan programs nationwide—an ideal solution for real estate investors focused on rental income. These loans are available in dozens of states, including Arizona, Georgia, New York, Texas, Florida, and more. Our DSCR programs qualify borrowers based on the cash flow of the property itself, not personal income or tax returns.

That means no W-2s, no pay stubs, and no employment verification. Whether you’re buying your first rental or expanding a multi-property portfolio, our nationwide DSCR loans provide fast approvals, minimal documentation, and competitive rates. At LBC Mortgage, we help investors across the country close deals quickly and confidently—no matter where the property is located.

Get in Touch

Whether you’re buying a home or are ready to refinance, our experts are here to help.